Trade Relief Lifts Sentiment, Tech Earnings Power New Highs | Weekly Recap: 21 July – 25 July 2025

Economic Overview

It was one of those weeks where markets exhaled, slightly. The sense of tension that has been hanging over global trade talks finally loosened, with Washington striking deals with Japan, Indonesia, and the Philippines, while conversations with Europe edged closer to resolution.

The US continued to send mixed signals. Services stayed strong while manufacturing slipped again. It’s a familiar theme now: consumers are keeping the show running while factories idle. With inflation hovering near target and no major shocks in sight, the Fed seems content to hold steady going into next week’s meeting.

In the UK, a 0.9% rebound in June retail sales was welcome, though still underwhelming. July PMIs ticked down a bit, reinforcing the market’s view that the BoE is likely to cut rates in early August. Meanwhile in the eurozone, sentiment lifted as trade tensions eased. After eight long rate cuts, that alone felt hawkish, and the bank gently signalled it is in no rush to react to minor inflation surprises. Composite PMI climbed back to 51.0, suggesting the region might be regaining its footing.

Over in Asia, Japan was the standout. News of a trade deal with the US, one that avoided steep new auto tariffs, gave markets a serious boost, especially for carmakers and exporters. On top of that, things calmed down politically at home, which gave investors even more reason to cheer. The result? Japanese stocks took off. Meanwhile in China, there was a bit of relief too. Trade talks with Washington are back on the table, and there’s growing talk that Beijing might roll out more support to keep the economy humming.

Equities, Bonds & Commodities

Equities ran with the good news. In the US, the S&P 500 added 1.5%, while the Nasdaq tacked on 1%, both hitting fresh highs. Earnings from the big tech names helped. The Dow climbed 1% too.

Across the Atlantic, the FTSE 100 popped 1.4%, helped on by strong bank and energy names. STOXX 600 rose 0.5%, with Italy and France drifting upward. Germany’s DAX fell slightly as investors locked in profits after a strong run.

Asia saw the most excitement. Japan’s Nikkei 225 jumped 4%, the best regional performance of the week. The US-Japan trade pact unlocked fresh optimism, especially for exporters. China wasn’t far behind. Shanghai’s main indices rose about 1.7%.

On the bond side, it was a gentle slide lower. US 10-year yields dipped to around 4.4%, while the 2-year eased to 3.8%, a sign that the market is comfortable with the Fed staying put.

Commodities were more subdued. Brent crude slipped 2% to $68 per barrel as supply remained ample and demand trends cautious. Gold held steady at $3,340 per ounce. Safe-haven demand cooled, but not enough to send bullion lower.

Sector Performance

The rally shifted this week, with Healthcare stealing the spotlight. It surged +3.86%, easily outperforming all other sectors, driven by strength in large-cap pharma and a rebound in biotech. Industrials followed with a +2.33% gain, benefiting from easing trade tensions and solid manufacturing earnings.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 25 July 2025.

Financials (+1.63%) and Energy (+1.62%) also performed well, supported by higher global risk appetite and positive economic surprises. Consumer Discretionary rose +1.28%, helped by travel and retail names, though not all constituents participated equally.

Utilities managed a modest gain of +0.22%, while Tech & Communication Services collectively inched up just +0.20%, lagging the broader rally despite a few strong earnings beats. Meanwhile, Consumer Staples slipped –0.06%, the only sector to end in the red, as investors leaned away from defensives in a risk-on environment.

Overall, cyclicals outpaced growth and defensives, confirming a rotation toward more economically sensitive sectors.

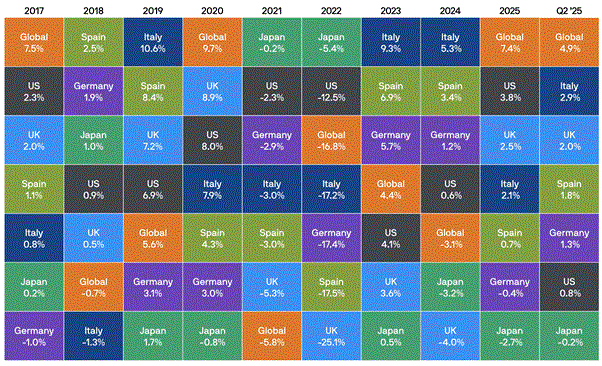

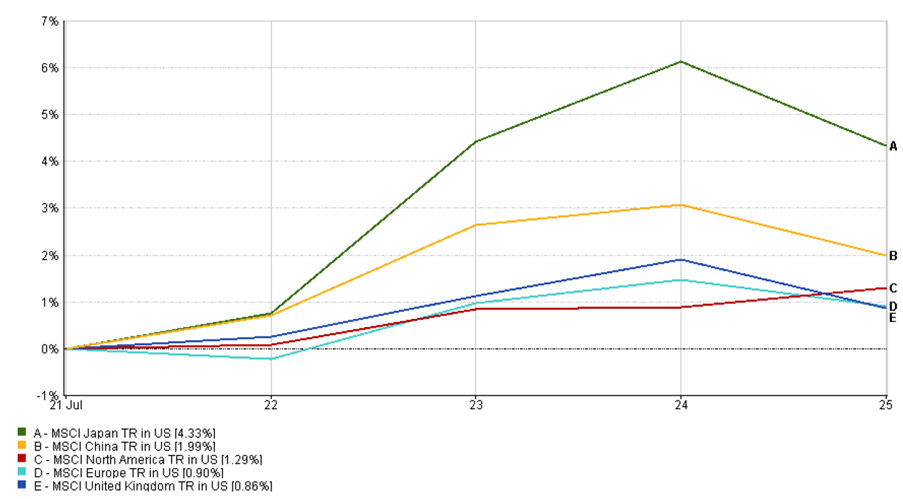

Regional Markets

Japan clearly stole the show. The MSCI Japan Index surged over 4% in US dollar terms, driven by a breakthrough auto tariff agreement with the US that capped export duties at 15%, easing fears of strict trade barriers. The deal gave a significant boost to Japanese exporters, especially automakers and manufacturers, just as domestic political tensions stabilised, improving investor sentiment. Adding fuel to the rally were growing expectations that the BoJ may shift to a slightly tighter stance later this year, as inflation trends and rising bond yields pointed toward policy normalisation.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 25 July 2025.

China followed with a 2% gain on policy hopes and renewed trade optimism. North America rose around 1.3% as earnings beat expectations, while Europe climbed 0.9%. Within Europe, Italy and the UK outperformed, and Germany lagged slightly. The MSCI UK Index rose 0.86% in US dollar terms, helped by banks and M&A headlines. Emerging markets mostly joined the rally.

Currency Markets

The US dollar lost some shine this week. The DXY fell from 98.5 to around 97, its biggest weekly drop in a month. The euro took advantage, with EUR/USD pushing up to 1.17, as the ECB’s calm messaging helped steady investor nerves.

Sterling was more sluggish. GBP/USD held around 1.33, with weaker UK data and BoE rate cut expectations keeping gains in check. EUR/GBP nudged above 0.87 as the divergence between UK and eurozone economic momentum widened.

The yen, for once, strengthened. USD/JPY dropped to 147.5, its best level in weeks, as the BoJ tightening narrative picked up steam. The yuan held steady near 7.15, with calm trade talks helping to anchor sentiment. Most emerging market currencies firmed slightly as the dollar faded and risk appetite returned.

Outlook & The Week Ahead

Next week brings a trio of major events. First up, the Fed’s 29-30 July meeting. No rate move is expected, but the tone of Powell’s statement will matter. Investors want clarity: are cuts coming this year, or is “higher for longer” still the plan?

Japan’s central bank also meets. No change is expected, though any signal of tightening later in the year could strengthen the yen and ripple across markets. In the UK, the BoE’s 1 August meeting may bring a cut, with softening growth strengthening the case.

Other key data includes US second-quarter GDP, core PCE inflation, eurozone CPI, and China’s PMIs. And that 1 August tariff deadline? Still hanging over markets. A last-minute surprise could trigger volatility, while a resolution might extend the rally. Earnings season also continues, with Apple, Amazon, and others reporting.

After July’s run-up, markets are now looking for confirmation. The next move belongs to policymakers.