The Case for Gold in a High-Debt, Low-Confidence World

Gold doesn’t pay you anything to hold it. No interest, no dividends, just a shiny metal sitting in a vault. And yet, in today’s uncertain world, it’s becoming increasingly valuable. Why? Because when returns on cash and bonds can’t keep up with inflation, investors start to care less about yield and more about safety and security.

Real Yields vs Gold Price (Jan 2020-Jul 2025)

Sources: Board of Governors of the Federal Reserve System (US); U.S. Bureau of Labor Statistics via FRED®

Shaded areas indicate U.S. recessions.

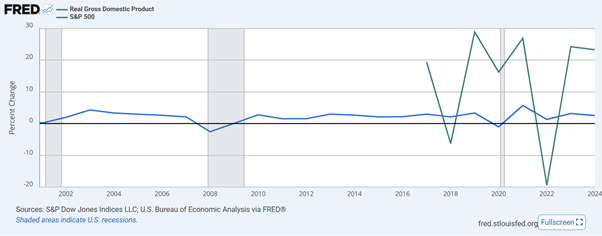

This chart shows how gold prices (brown) and real yields (blue) have diverged over time. Notice how gold tends to rise when real yields fall, especially during 2020-2021 and again in 2023–2025.

That’s exactly what happened during the pandemic. Central banks slashed interest rates to support their economies. Inflation surged. Real yields (the returns you get after accounting for inflation) dropped below zero. And gold? It soared. It wasn’t offering a return, but at least it wasn’t losing value in real terms unlike other assets. In fact, it was gaining.

But then, from 2022 to 2023, central banks reversed course. They raised rates aggressively to fight inflation. Gold cooled off. But not for too long.

Despite higher interest rates, gold began climbing again in late 2023. Why? Because fear took over. With war, political tension, and economic slowdown looming large, investors turned to something reliable. Gold was right there, no promises, but no surprises either.

Why Central Banks Keep Buying Gold

Here’s something interesting: it’s not just private investors pouring into gold. Since 2022, central banks have been on a gold-buying spree, adding over 1,000 tonnes a year. That’s not a coincidence.

They’re hedging their bets. With global debt at record highs and trust in the US dollar wavering, countries like China, Turkey, and India are diversifying. Gold is neutral. It’s not tied to any government or central bank. And in a world where geopolitics can shift overnight, that neutrality is a big deal.

In 2024 alone, central banks spent around $80 billion on gold, about a third of all newly mined supply. That kind of demand helps explain why gold prices have held up even when interest rates haven’t been supportive.

Gold’s Journey Since 2020

At the end of 2019, gold traded around $1,500 per ounce. By mid-2025, it had more than doubled, sitting above $3,300. That’s not a fluke. It’s a response to a world that’s more chaotic, more indebted, and more anxious.

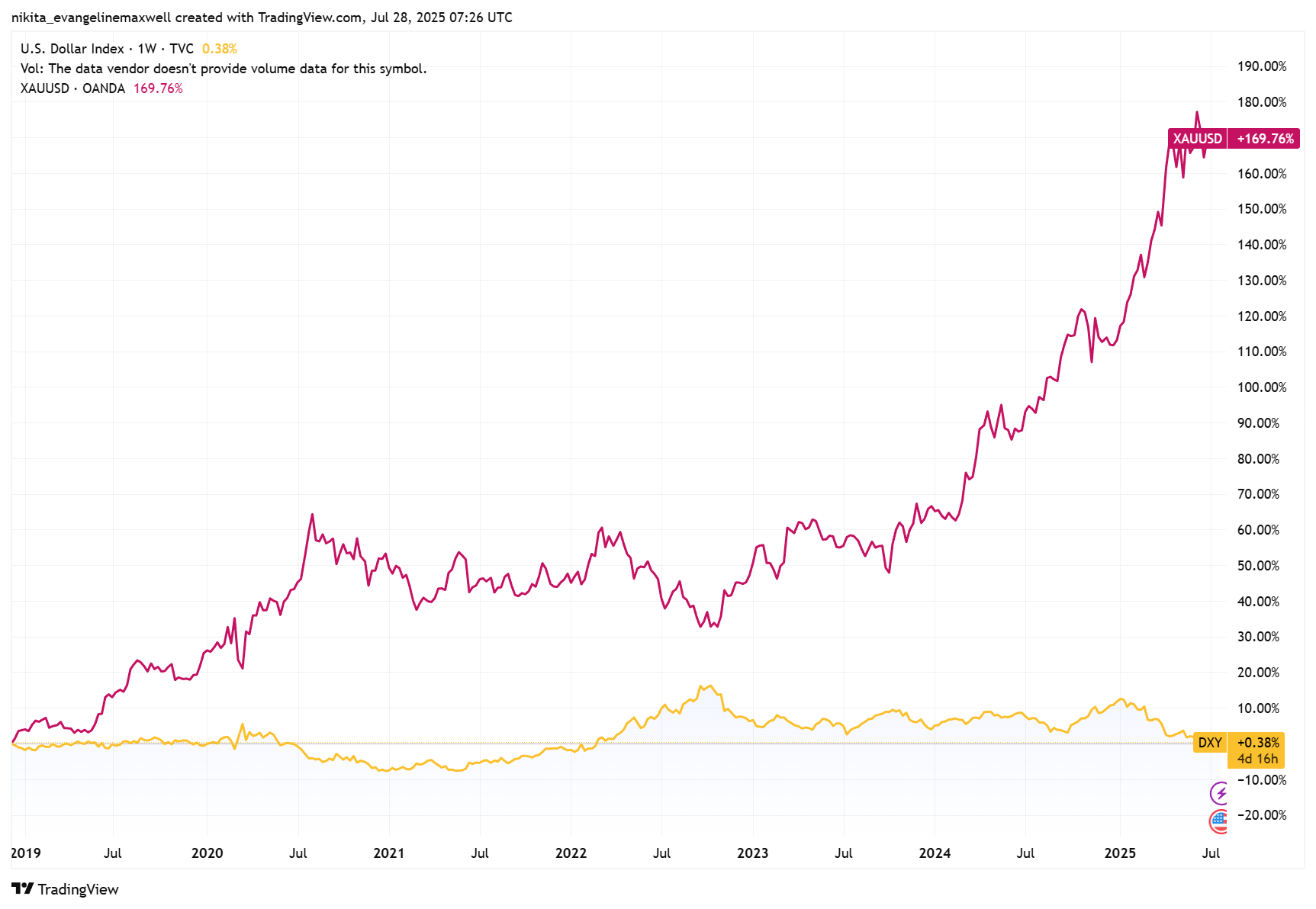

DXY vs Gold: The Dollar’s Drift and the Metal’s March (2019-2025)

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 28 July 2025.

As the US dollar lost momentum post-2022, gold surged past $3,000, signalling a flight to safety and distrust in fiat currency strength.

Gold’s initial jump in 2020 was a panic move, investors fled to safety. Then came a pause. Rates went up, gold pulled back. But in 2023, it rallied again, thanks to renewed central bank demand, a weakening dollar, and rising global tensions.

And here’s the key point: gold’s recent gains haven’t just been about interest rates. They’re about trust, or the lack of it.

How It Compares: Gold vs Bonds vs Bitcoin

Let’s zoom out. Since 2020, gold has doubled in value. Government bonds? They’ve lagged, especially in 2022 when inflation spiked. Bitcoin? It’s had a wild ride, from $7,000 to over $120,000 at times. But it’s volatile, unregulated, and still struggling to prove itself as a long-term store of value.

Gold sits in the middle. It hasn’t shot to the moon like crypto, but it hasn’t burned investors like bonds either. It’s steady. Predictable. And in a crisis, that matters more than you might think.

Total Returns: Gold vs Bonds vs Bitcoin (2020-2025 YTD)

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 28 July 2025.

Gold has nearly doubled since 2020, outperforming US bonds and offering a steadier ride than Bitcoin, which soared but with massive swings.

Why Gold Still Makes Sense

The global debt burden is staggering. Governments spent massively during the pandemic, and they haven’t slowed down. The US alone owes over $32 trillion. Japan’s debt is more than twice its GDP. These aren’t numbers you can ignore.

The more debt a country carries, the less room it has to raise rates, because higher rates mean higher interest payments. So even if inflation is a problem, central banks may be forced to keep rates low. That’s a setup where gold tends to thrive.

In short: gold isn’t just about returns. It’s about protection. In a world full of unknowns, that’s worth a lot.