How Oil Shapes Everything: From Inflation to Tech Valuations

Oil has this ability to grab the centre stage. A big swing in crude prices can reset inflation expectations almost overnight, unsettle central banks, and shuffle stock-market winners and losers. Think back to 2022. Crude shot up as economies reopened and supply chains buckled, feeding one of the sharpest inflation spikes in decades. The Energy sector loved it. Tech, not so much. Which makes you wonder if oil is really pulling the strings, or just playing a noisy side role?

What Actually Drives Oil?

Strip it down and oil still trades on the old basics: supply and demand. OPEC+ trims production here, US shale adds barrels there, and China’s appetite either props it up or lets it sag. Brent even touched $120+ a barrel in 2022, only to cool closer to $80 in 2023 once demand lost steam. Now most forecasts sit in the $70s for a while before dipping into the $60s by mid-decade.

But forecasts? They’re slippery. One OPEC surprise, or a flare-up in the Middle East, and prices can lurch higher. Equally, a global slowdown can crush demand and send crude tumbling. That’s the thing with oil. It’s less of a smooth trend and more of a tug-of-war, with the rope constantly moving back and forth.

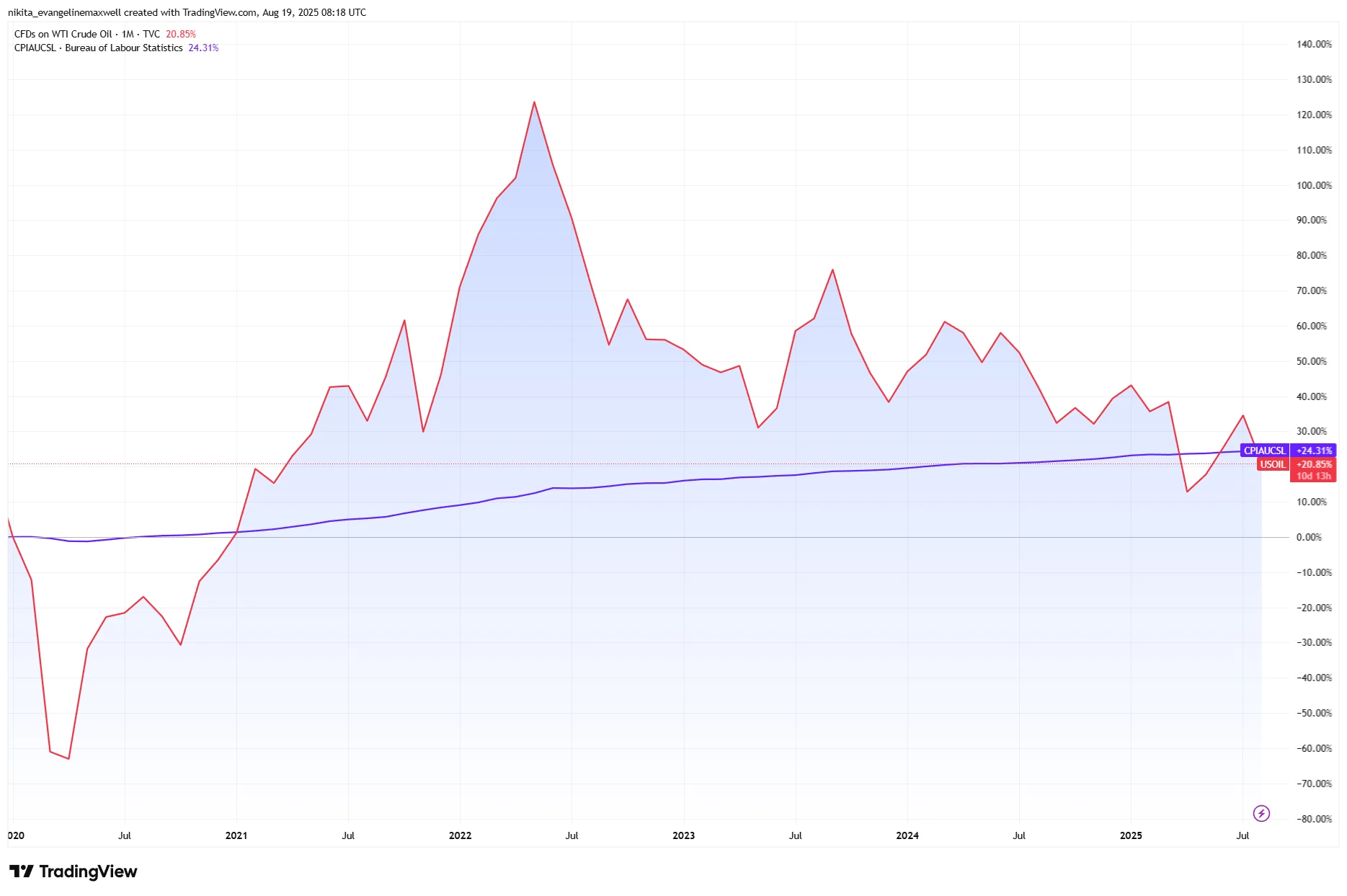

Oil and Inflation

The textbook says higher oil = higher CPI. More expensive fuel, heating, shipping. It all feeds into consumer prices. The IMF even reckons a 10% oil jump adds about 0.4 percentage points to inflation globally. We saw that in 2022. By the time crude eased in 2023, headline inflation cooled.

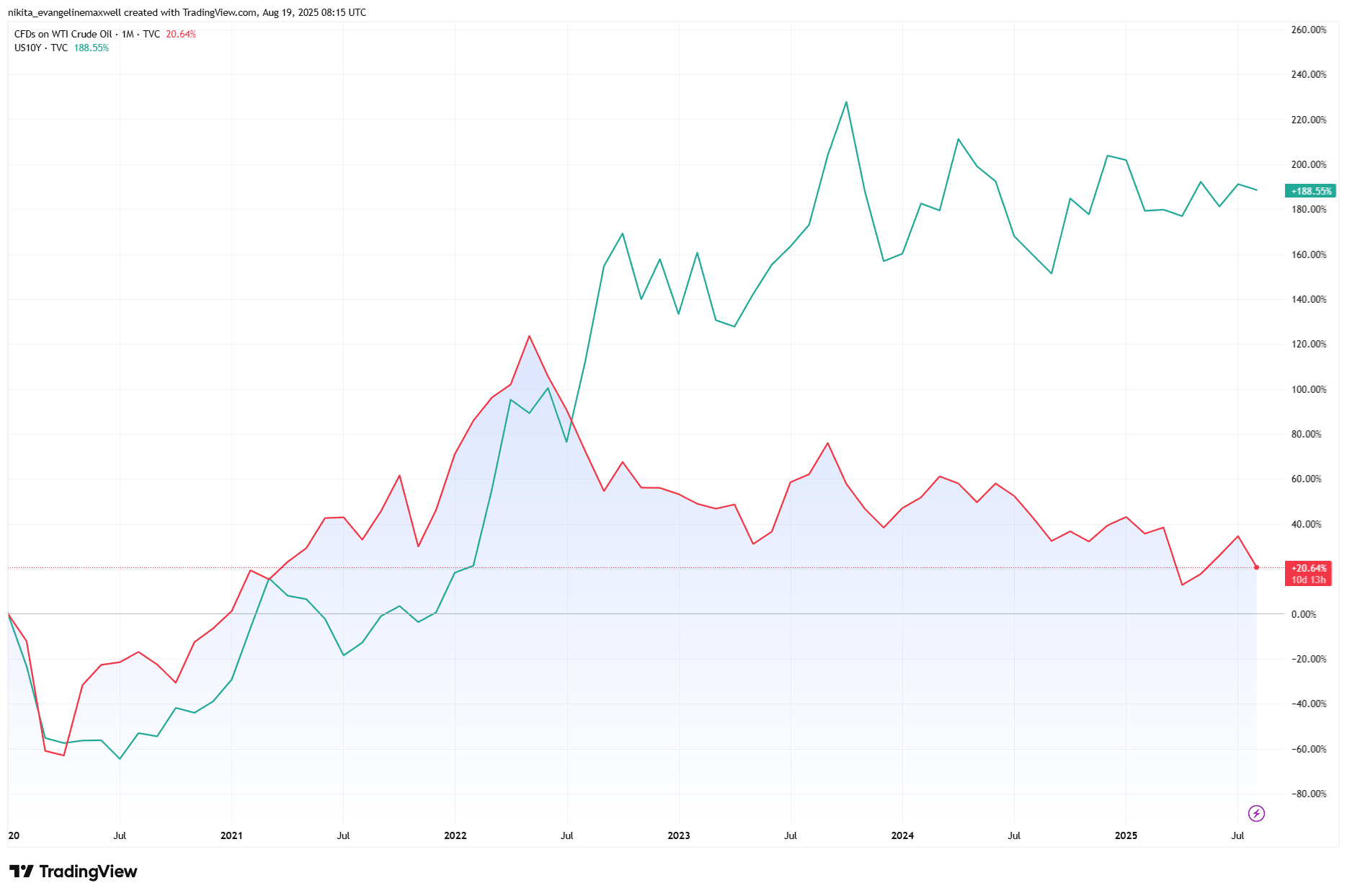

Oil and US Treasury Yields: A Post-2020 Divergence

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 19 August 2025.

But, (and this is where it gets tricky!) the link isn’t as neat as it used to be. In many advanced economies, the “second-round effects” (oil driving up wages and rents) have weakened. Sometimes oil’s just a reflection of strong global demand rather than the culprit itself. Which means a drop in oil doesn’t always mean inflation is beaten. Other forces like wages, supply bottlenecks, even currency swings, can keep the pressure alive.

The Policy Feedback Loop

Central bankers watch oil very closely. They can’t control it, but it shapes how credible they look. A spike often keeps them talking tough, a dip buys them breathing space. Take 2024 for example. US gasoline fell, easing headline inflation, and the Fed could pause. But sticky core CPI kept policymakers cautious. Oil, in that sense, isn’t the driver of monetary policy so much as a noisy passenger that makes the journey bumpier.

And don’t forget the loop. Higher rates can cool demand, which eventually softens oil. So crude is both a cause and an effect, a mirror of the global economy and, at times, a nudge that changes its direction.

Oil and Inflation: Peaks Aligned, Trends Diverging

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 19 August 2025.

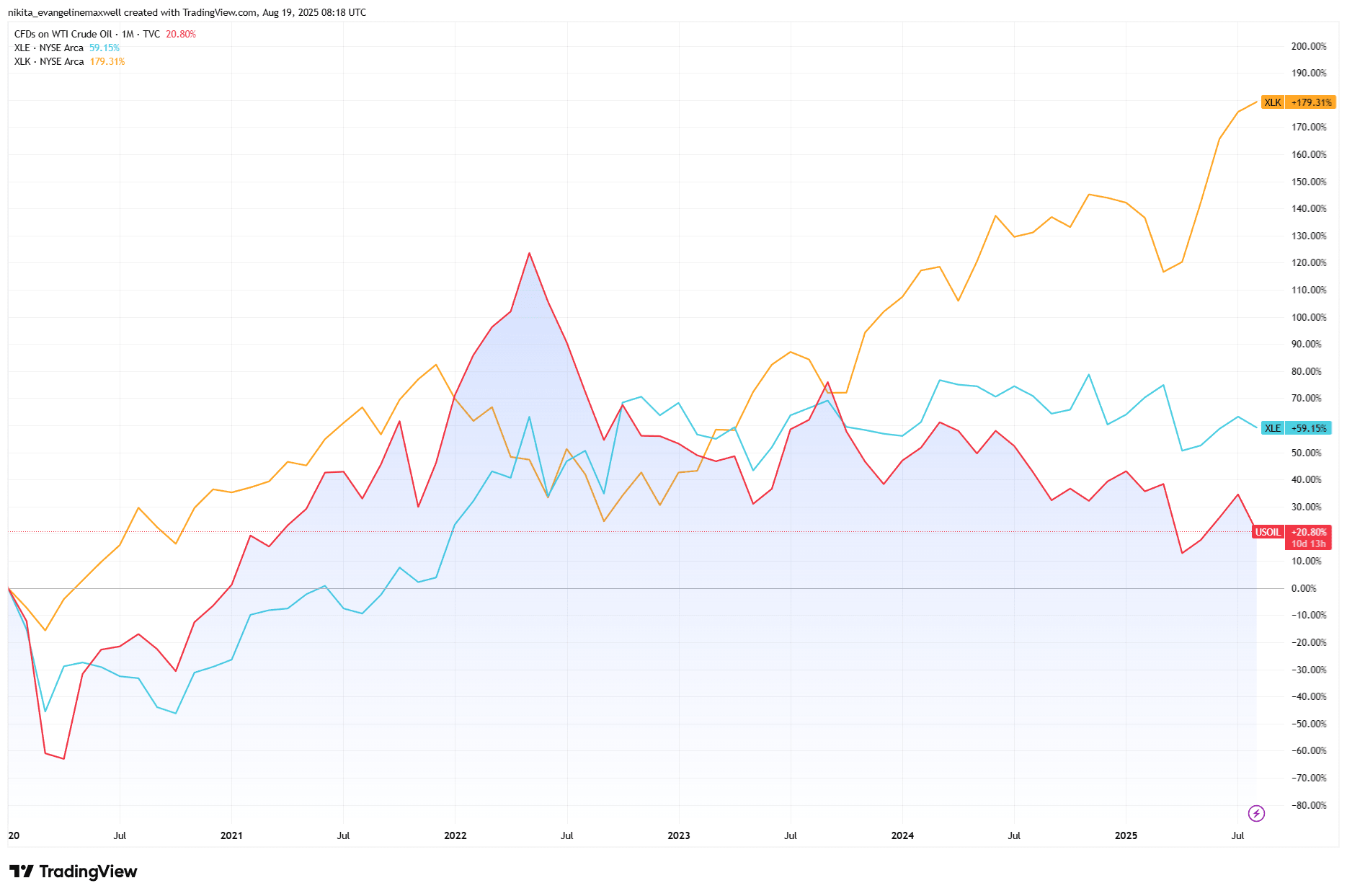

Markets, Sectors, and the Ripple Effect

If you’re an investor, the clearest impact shows up in sector leadership. When crude jumped in 2022, energy was the top-performing corner of the S&P 500. Tech got hammered. Bonds, too, since oil-driven inflation pushes yields higher. Fast forward a year, oil fell back, and suddenly tech regained ground while energy lagged.

And then there’s gold. Its behaviour around oil shocks is inconsistent, sometimes it rallies as an inflation hedge, other times rising real yields hold it down. That’s why oil feels more like a tide than a lever. It lifts some boats, sinks others, and forces portfolio shifts even if you’d rather ignore it.

Crude Oil vs Sector Performance: Energy Benefits, Tech Races Ahead

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 19 August 2025.

Risks and Exceptions

Of course, not every oil surge plays out the same way. If supply cuts hit while global growth is already weak, the inflation effect might be muted. Then there’s the bigger structural story, the energy transition. Renewables, EV adoption, and efficiency gains will, over time, chip away at oil’s power. On the flip side, ultra-low prices can be just as unsettling, hinting at collapsing demand or outright deflationary risks.

The Takeaway

Oil isn’t the market’s destiny, but it’s a useful signal. Its swings ripple into inflation, shape central-bank tone, and reshuffle sector leadership. For investors, the lesson isn’t to overreact but to stay balanced. Tilt toward energy and commodities when oil’s running hot, but keep an exit plan, because reversals often come quicker than expected. At the end of the day, oil’s not the whole story, but it’s a clue worth watching