European Banks vs US Banks: Who’s Better Positioned for Lower Rates?

After two years of rapid rate hikes, central banks are finally shifting gears. The ECB has already cut its benchmark rate back down to around 2% after peaking near 4%, while the US Fed is only just starting to trim from its much higher peak. That divergence leaves investors asking an awkward question: if rates keep sliding, which side of the Atlantic has the stronger banks?

Falling rates usually compress net interest margins (NIM). NIM is the gap between what banks earn on loans and what they pay on deposits. For banks that rely heavily on interest income, that squeeze can bite fast.

Key Drivers

One big difference is where the money comes from. Roughly 60% of European banks’ income is from net interest, compared with far less for US banks, which also earn chunky fees from credit cards, investment banking, and wealth management. That mix matters: when loan spreads narrow, European banks feel it more directly.

That said, they’ve seen this movie before. Europe’s banks spent a decade grinding through near-zero and even negative rates. It hurt badly, but it also forced deep cost-cutting and balance sheet clean-ups. US banks, by contrast, never had to operate in that world – they’ve enjoyed fatter margins, but they’re arguably less tested if rates plunge quickly.

Another factor is deposit pricing. When rates shot up, banks were quick to lift lending rates but slow to raise deposit rates. If policy rates fall, they’ll try to reverse that. European lenders have practice here – during the negative-rate era, many kept deposit costs close to zero. US banks with strong retail franchises can do it too, but those relying on more price-sensitive deposits could find margins eroding faster.

Fundamentals

On profitability, Europe has quietly closed much of the gap. Their ROE has climbed to around 10% this year, and bank shares surged more than 50% in early 2025. Investors are finally paying above book value for many of them – something that felt unthinkable a few years ago. US banks still enjoy richer valuations, though, reflecting their track record of stronger profitability.

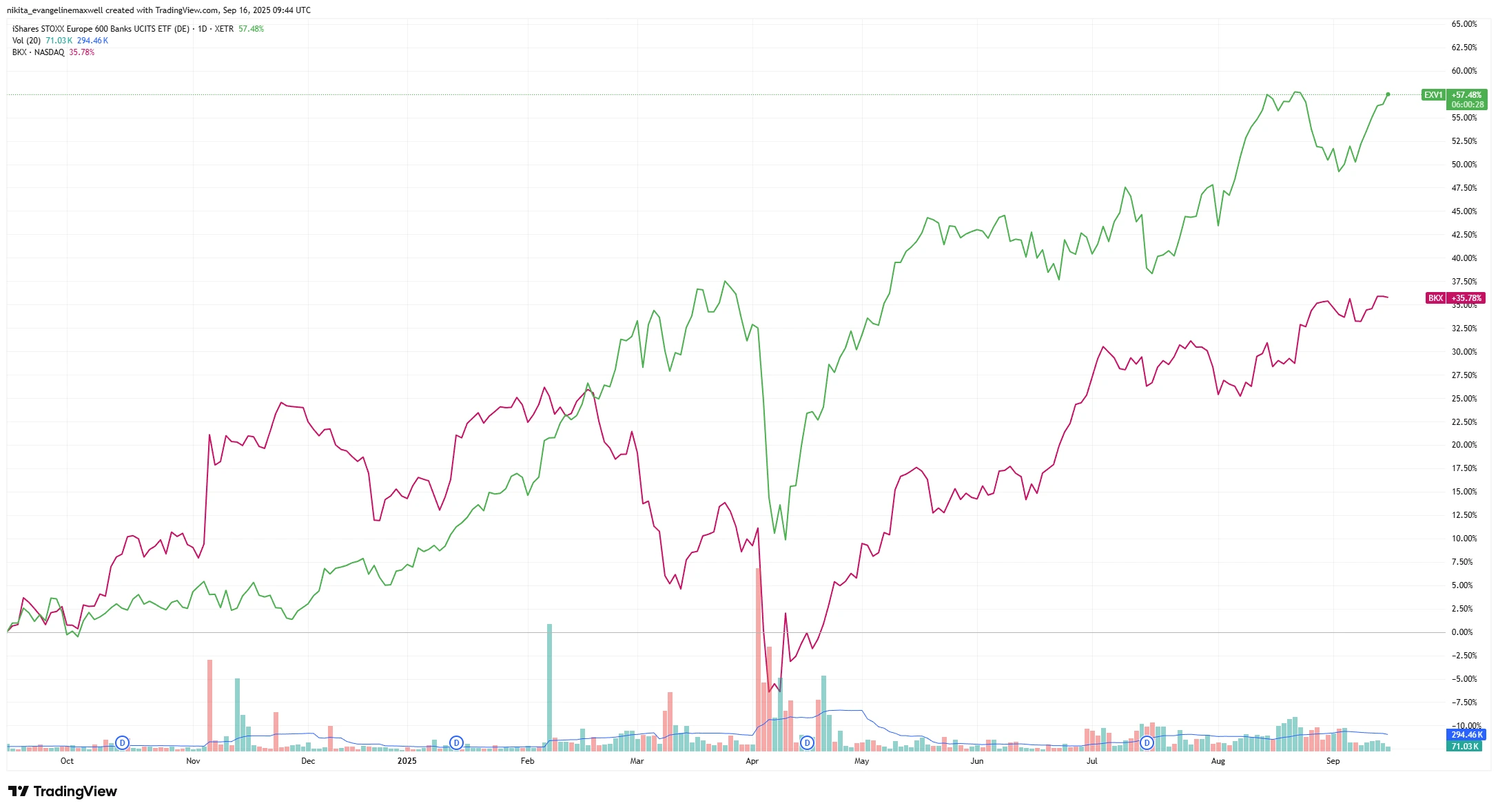

1-Year Price Performance of European vs US Banks (EXV1 vs BKX)

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 16 September 2025.

European bank stocks have outpaced their US peers over the past year, reflecting stronger earnings and improving investor sentiment. This price difference shows how quickly sentiment has swung. A year ago, investors barely touched European banks; now they’ve outperformed their US counterparts as markets priced in peak rates.

US banks are earning about 3% on net interest, nearly double Europe’s 1.6%. That gives them more breathing room as rates fall. Europe’s thinner margins could compress faster, though years of cutting costs and investing in digital systems may soften the hit.

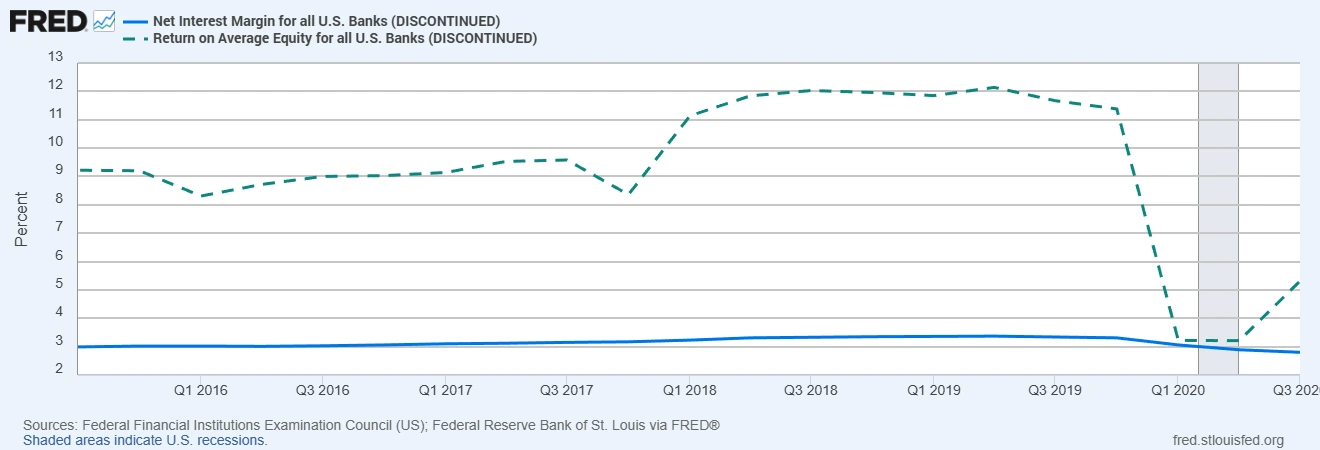

Net Interest Margin and Return on Equity for US Banks (latest available)

Sources: Federal Financial Institutions Examination Council (US); Federal Reserve Bank of St. Louis via FRED® (Data as of Q1 2023)

Shaded areas indicate U.S. recessions.

US banks operate with structurally higher margins and profitability, giving them more room to absorb a downturn. This spread explains why US banks can weather falling rates for longer – their earnings power gives them a built-in cushion that many European lenders still lack.

Balance sheets, meanwhile, are robust on both sides. Credit quality is solid, non-performing loans are low, and capital buffers are strong – roughly 16% CET1 (Common Equity Tier 1 – a ratio for European banks) for Europe, 12-14% for big US banks. That gives both regions space to absorb lower profits without immediately cutting dividends or buybacks.

Macro & Risks

The ECB seems close to done cutting, which removes the spectre of negative rates but leaves Europe facing sluggish growth. Loan demand could stay weak. The US has a shot at a soft landing, which might boost credit growth, but it faces its own headwinds: an inverted yield curve, tighter regulations, and creeping stress in consumer credit and commercial real estate.

The real risk is a sharp margin squeeze if rates drop faster than expected. Europe’s banks would likely feel it first, but US regionals could struggle too. A credit shock is another concern: US lenders are more exposed to credit cards and property loans, while Europe could wobble if energy costs spike or SMEs start defaulting. Add in the wild card of politics – windfall taxes in Europe or tougher capital rules in the US – and neither region gets an easy ride.

Takeaway

If you had to pick, US banks probably have a slight edge. Their higher margins and diversified income streams give them more ways to weather falling rates. But Europe’s banks aren’t the fragile players they once were – they’ve rebuilt capital, become leaner, and proved they can deliver solid returns.

For investors, it may not be about choosing sides. The smarter play might be watching how margins and loan growth evolve over the next few quarters… and keeping a bit of both on the radar.