Japan’s Market Revival: Earnings Led or Currency Led?

A Market Reawakening

Japanese equities have attracted attention, with the Nikkei 225 returning to levels last seen in the late 1980s and the TOPIX moving higher. This rebound has prompted investors to revisit a market associated with slow growth. The tone around Japan has changed, and not just at the margin. The key question now is whether this strength reflects improvement in how companies are run, or whether it is being flattered by a weaker yen and overseas investors positioning for gains.

It seems that the answer is not one or the other. Japan’s market is responding to more than one catalyst, and the debate matters. A rally driven by exchange rates is fast and reversible. A rally driven by earnings and corporate decisions is slower, and more durable.

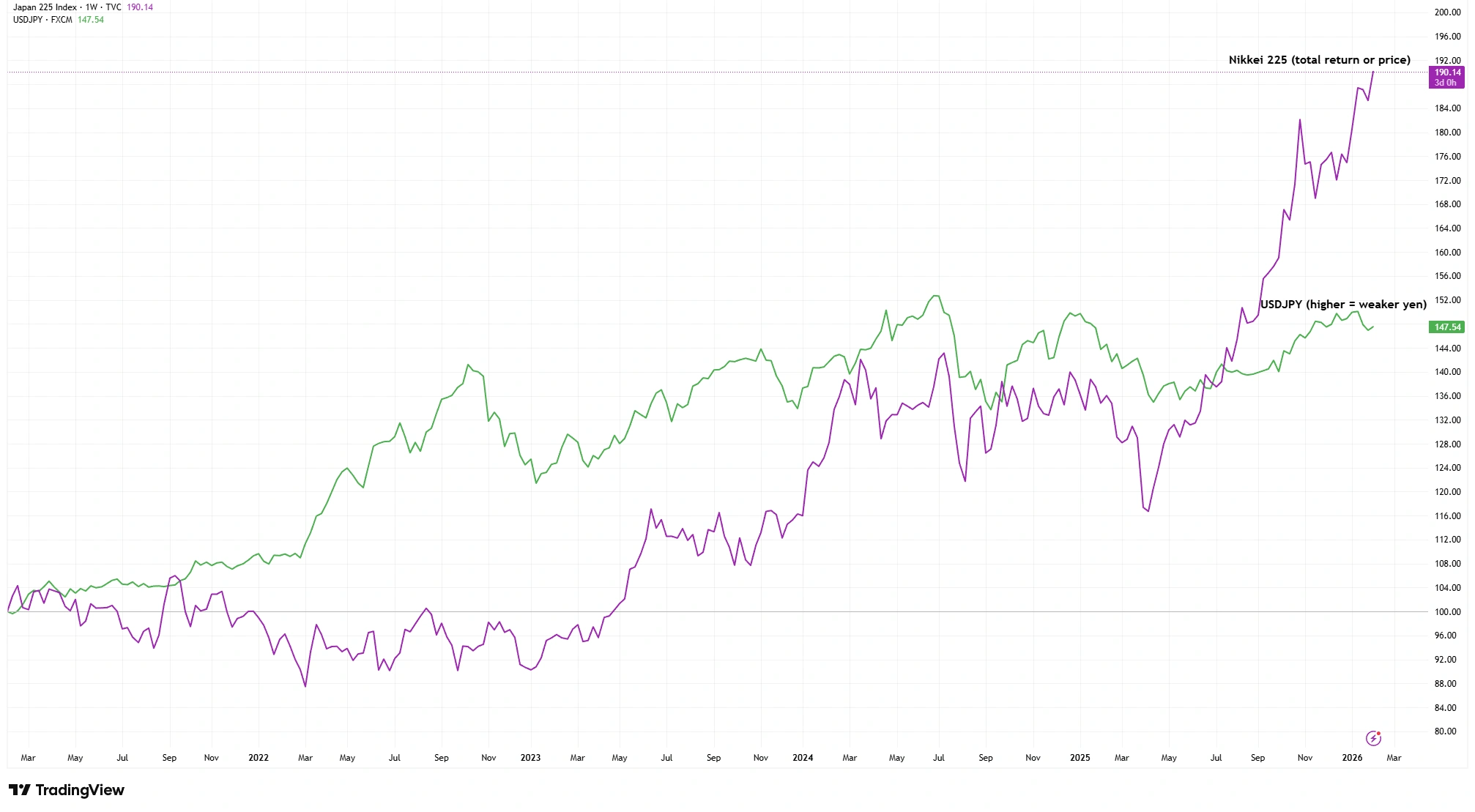

Currency Dynamics and Policy Backdrop

The yen has been weak for years and has become a driver of Japan’s market performance. Japan has kept interest rates low compared with the US, making the yen less appealing to global investors. As investors shift towards those assets, they sell yen and buy dollars, and selling pressure pushes the yen down. A weaker currency makes overseas profits look larger and helps exporters by making products more competitive.

Nikkei 225 versus USDJPY (5-Year Performance)

Source: TradingView. Indexed to 100. Past performance is not a reliable indicator of future performance. Data as of 3 February 2026.

Japan’s central bank has said interest rates may rise later, but they remain low, keeping borrowing costs low. Japan’s reopening to travel has brought in visitors and supported the domestic economy, while import costs have squeezed households. Inflation has cooled from highs, but it is still firm enough to keep policymakers debating how quickly to adjust.

Currency weakness can lift headlines and profits, but it can create uneven outcomes. Beneath the index level, you see tension between export benefits, import pressures, and that tension shapes how long a currency tailwind can last.

Corporate Japan’s Evolving Earnings Profile

The rally is not purely a currency story. Corporate Japan has been improving, with signs of profitability, capital use and a willingness to reward shareholders. You can sense a shift as companies discuss returns, capital allocation, and what it means to be valued. Companies have stepped up buybacks, set return on equity targets and become more selective about businesses they keep or sell. These changes have been encouraged by the Tokyo Stock Exchange, which has urged firms to focus on how efficiently they use capital and how the market values them. It represents a shift for a market viewed as inexpensive but slow to deliver returns, even if reform varies by company.

The more I look at Japan’s corporate direction, the harder it is to dismiss that something is evolving. But it suggests Japan is no longer “cheap by habit.” The market is judging whether cheapness is being replaced by credibility.

Not all earnings strength reflects long term improvement. A weaker yen has boosted profits of multinational companies, and a rebound in inbound tourism has lifted service income. These are real drivers, but they can fade if conditions change, if the yen strengthens or if the gap between Japanese and global interest rates narrows. Part of the earnings story is reform, and part is the cycle.

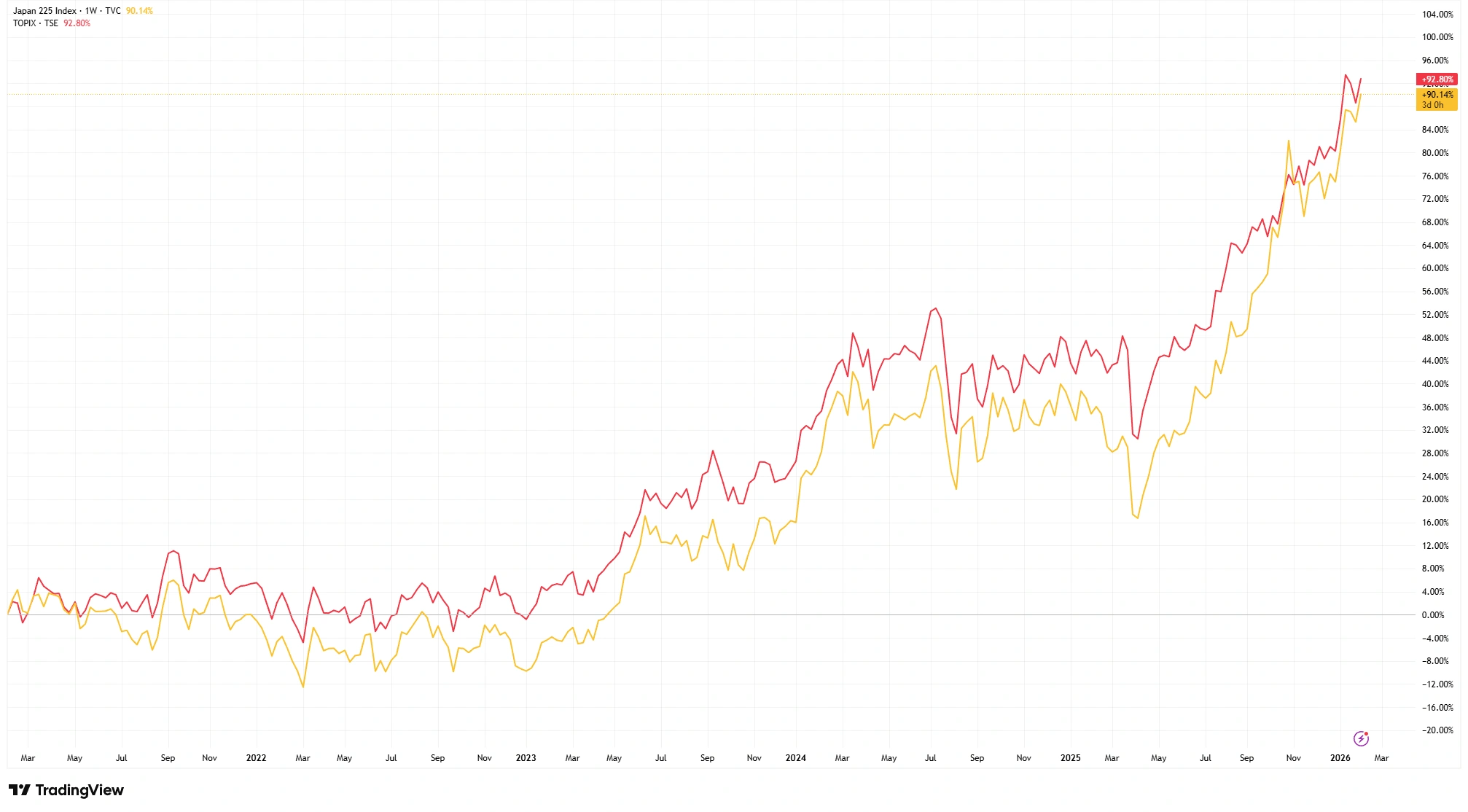

Nikkei vs TOPIX: Reading the Signal

The behaviour of Japan’s main indices offers clues about what is driving the market. The price weighted Nikkei 225 is influenced by a group of high priced stocks, giving it a momentum driven profile. The market cap weighted TOPIX, by contrast, covers a wider set of companies and can show how the market is performing.

Nikkei 225 versus TOPIX (5-Year Performance)

Source: TradingView. Past performance is not a reliable indicator of future performance. Data as of 3 February 2026.

Both indices rising suggests the rally is not just exporters. Financials, industrials and service sector companies have participated, pointing to a market responding to currency conditions, corporate reforms and a steadier backdrop. That breadth is a healthier signal than a rally carried by a narrow handful of names.

Investor Implications

Currency driven rallies can be powerful but fragile. If the yen strengthens or if expectations of global interest rate gaps narrow, exporters’ earnings could face pressure and reveal how much momentum was helped by currency effects rather than growth. Structural reform may provide counterbalance. If companies improve capital efficiency and deliver reliable profitability, Japan could justify a stronger market with a firmer currency.

Japan’s latest upswing may have been sparked by the weak yen, but resilience will depend on earnings. The more corporate Japan demonstrates discipline and consistent returns, the market’s foundations will rest on fundamentals rather than foreign exchange. Japan’s story is still unfolding, and we watch closely.