Forex Trading Terms: Pips, Lots, Spreads and Leverage

Are you new to forex trading and feeling overwhelmed by all of the trading terminology? You’re not alone! If you want to understand what is a lot in forex or what is spread in trading forex, you’ve come to the right place. In this article, we are going to break down the most essential forex and stock trading terms that every beginner trader needs to know. We'll answer the most common questions everyone has at the start of their trading journey like 'what is a lot in forex?', 'what is a pip?' and 'what is spread in trading forex?'. We'll also look at what lot size forex traders can choose to trade as well what leverage is. Let's go!

- Understanding Trading Terms:

- Why trading terminology gives you an edge in the market:

- A few more key trading terms that every beginner needs to know:

- Tips for understanding and using key trading terms in real life practice:

- Common mistakes with trading terms:

- A summary of the key trading terms:

- Stock trading terms vs Forex trading terms:

- Trading Terms Conclusion:

Understanding Forex Trading Terms

First things first, let’s dive into why forex trading terms are so important. Understanding forex trading terminology is key to laying the foundations of your trading knowledge. The terms explored in this article will form the basic language of the forex market. Understanding these terms is crucial as they will have a direct impact on risk, strategy development and potential profit / loss. Let's take a take a deeper look!

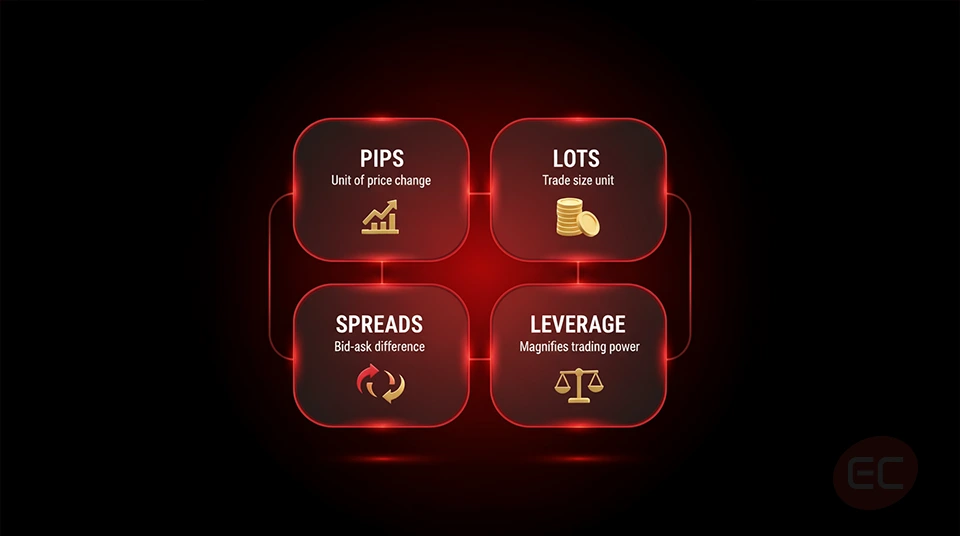

What is a Pip in Forex? | Forex Trading Terms

A 'Pip' stands for 'Percentage in Point', also known as 'Price Interest Point'. It represents the smallest price movement of a currency pair in the forex market. Major currency pairs are generally priced to four decimal places, so one pip is typically equal to 0.0001. However, JPY pairs are an exception and are quoted in the 2nd decimal point, so one pip is typically 0.01.

For example, if the EUR/USD moves from 1.1050 to 1.1051, the price has increased by one pip. The pip is a crucial piece of forex trading terminology because knowing what it means will enable you to measure how much a currency pair's price has risen or fallen during a specific period. When combining the pip with lot size, we can calculate the pip value, which we can then use to determine the potential profit or loss for a trade. Understand this first, then we'll go into more detail about the lot size, pip value and profit / loss calculation soon.

What is a Lot in Forex? | Forex Trading Terms

Now that we know what a pip is, let’s answer another common question that beginner traders ask: 'what is a lot in forex?' The term 'Lot' refers to a fundamental concept in sizing your trades. It represents the volume or quantity of a trade. To give you a better idea, here are four typical types of lot size forex trading involves:

1) Standard lot = 100,000 units of currencies

2) Mini lot = 10,000 units of currencies

3) Micro lot = 1,000 units of currencies

4) Nano lot = 100 units of currencies

The lot size forex traders choose for a trade will have a direct impact on how much each pip is worth. This is what we call 'pip value'. The larger the pip value, the higher the potential profit / loss will be.

Below is an example of how lot size will impact the profit of a trade.

Let’s say you've opened a long position of EUR/USD at 1.2000 and close it at 1.2050. In this trade, you have gained 50 pips. Your position size, or what you may call the 'Lot Size', will determine the actual profit of this trade.

IMPORTANT: Profit and loss is denominated in the quote currency (2nd currency in the forex pair). So in this EUR/USD example, it will be USD.

Scenario One

Your position size is one lot (100,000). The pip value will be:

0.0001 x 100,000 = 10 USD per pip

50 pips profit will translate into:

50 x 10 = 500 USD

Scenario Two

Your position size is ten lot (1,000,000). The pip value will be ten times larger than what it would in a one lot position:

0.0001 x 1,000,000 = 100 USD per pip

Same 50 pips profit in dollar terms will be ten times larger as well

50 x 100 = 5,000 USD

As you can see, position size plays a crucial role in determining the potential profit of your trade and it is even more important when it comes to losses. Using the same EUR/USD trade example, if instead of going long, you opened a SHORT position at 1.2000 and covered it at 1.2050, you would have made a loss of 50 pips. A position size of one lot would result in a 500 USD loss and a 10 lot position would result in a loss of 5,000 USD. If your trading capital is 10,000 USD, these losses are 5% and 50% of your trading capital respectively. This is why position sizing is a critical component of risk management in forex trading.

What is Spread in Trading? | Forex Trading Terms

Ah, the spread! It’s a powerful tool in trading terms. But what is spread in trading? Spread is the difference between the bid price and the ask price (what buyers are willing to pay and what sellers want to receive).

To put it simply: Assuming the EUR/USD has a bid of 1.1050 and an ask of 1.1052, the spread is 2 pips.

Understanding what is spread in trading helps you choose the right broker as well as the right trading times. Tighter spreads often mean lower trading costs. The wider the spread, the more the trade needs to move in your favor to become profitable. It’s crucial to understand spreads because high spreads can eat into your profits, particularly if you’re trading frequently or using forex leverage to open a larger position.

4) Trading terms: Forex Leverage

Let’s talk about one of the most powerful tools in trading: Forex leverage. What is forex leverage? Forex leverage allows you to control larger trading sizes with a smaller amount of real money (margin). Let’s look into it a little deeper, here’s an example: assuming you have 1:100 leverage, you can trade $100,000 with just $1,000 in your account. But how does this really work? Should the market movement be in your favour, you can make much larger profits, however should the market movement be against you, your losses are also magnified. Forex leverage is considered a double edged sword and is important for beginners to use it carefully. As much as it can boost your trade, it can also bust your account.

Why trading terminology gives you an edge in the market:

Learning trading terminology isn’t just academic, it's about giving you a strategic edge.

Here’s how:

- Understanding trading terminology helps you calculate profit and loss more accurately.

- It ensures better risk management.

- Increases confidence when using platforms and broker tools

- Understanding the right trading terminology gives you a clear communication path when in contact with other traders.

A few more key trading terms that every beginner needs to know:

Here are a few related trading terms you’re likely to hear:

Margin: Margin is the amount of actual money you will need to open a leveraged position, it’s directly tied to forex leverage.

Equity: Equity refers to the total value of your account including profits and losses.

Stop Loss & Take Profit: These are pre-set levels that lock in your gains or automatically close your trade in case of market volatility to manage risk.

Understanding these key terms in addition to lot size forex, pips, and spreads ensures that you know the meaning behind these terms in case trading platforms or brokers use them.

Tips for understanding and using key trading terms in real life practice:

1) Start with a demo account: Practice first on a demo account using real trading terms without risking your actual capital.

2) Review your trades carefully: After placing a trade, review spreads, lot sizes and leverage have affected your result.

3) Choose your broker carefully: Brokers offer a variety of Forex leverage, spreads and lot size forex flexibility. You can view the EC Markets Leverage options here.

4) Keep an eye on financial news: Changes in spreads and pip movement tend to come after big market events, understanding and identifying why these changes happen can give you an edge ahead of time.

5) Keep a trading journal: Get into the habit of writing down your trades, the trading terminology used and involved, as well as the lessons you’ve learnt.

Common mistakes with trading terms:

Even highly experienced traders can make mistakes, which is why it's crucial for these trading terms to become native to you. Here are some common mistakes to avoid:

1) Misjudging what is spread in trading, especially during times of high market volatility.

2) Overusing or misusing forex leverage, which can lead to high risk and rapid losses.

3) Confusing position size with lot size.

4) Not focusing on how many pips a trade must move in order to become profitable after spreads.

When you understand these common mistakes and why trading terminology is crucial to a successful trading experience you will be better prepared and avoid unnecessary mistakes that can cause damage to your potential profits.

A summary of the key trading terms:

What is a Pip? The smallest price movement, usually 0.0001 in forex.

What is a Lot in forex? The trade size - The different of lot size forex trades can be are Standard, Mini, Micro or Nano.

What is Spread in trading? The difference between bid and ask prices.

What is Leverage? The ability to trade more than you own by borrowing temporarily from your broker.

How do these trading terms apply to real life scenarios? Let’s look at some examples:

Assuming you open a forex trade of 1 mini lot (10,000 units) on the GBP/USD. The spread is 2 pips. With no leverage, you’d need around $13,000. With Forex leverage of 1:100, you would only need a $130 margin. If the price moves to 10 pips in your favor, you’d earn $10.

Understanding trading terminology can dramatically change your perspective, every number has a meaning and every move has an impact.

Stock trading terms vs Forex trading terms:

Although there is a slight overlap, stock trading terms and forex terms have quite a few differences. For example, in stock trading, volume is measured in shares, not in lots. Spread in stocks often refers to bid and ask differences for equities. Leverage is generally lower in stock trading (for example 2:1 or 4:1) as opposed to Forex Leverage (which can be up to 500:1 in some regions). Learning the right trading terminology is the first step to mastery.

Trading Terms Conclusion:

If you’ve made it this far into the trading terms course, you should by now have a good understanding of the below:

- What is a pip

- What is a lot in forex

- How to choose the right lot size forex

- The importance of what is spread in trading

- The power and the risk of Forex Leverage

- The importance of understanding both stock trading terms and forex trading terminology

If you’re serious about getting started with trading forex, it’s imperative to make sure that these trading terms are second nature to you. Understanding how leverage works, what is spread in trading, what is a lot in forex and the different types of lot size forex trading involves can make the difference in your trading experience and can change how you manage risk as well as seize opportunities in the market. It might seem like a lot of terminology, but remember every successful trader was once a beginner, the difference between a successful trader and a beginner is about practice, education and staying informed. Don’t just trade, trade with knowledge! If you’re ready to deepen your knowledge and keep reading the EC Markets Academy as we unfold more crucial trading education that will take you from a beginner to an experienced trader.